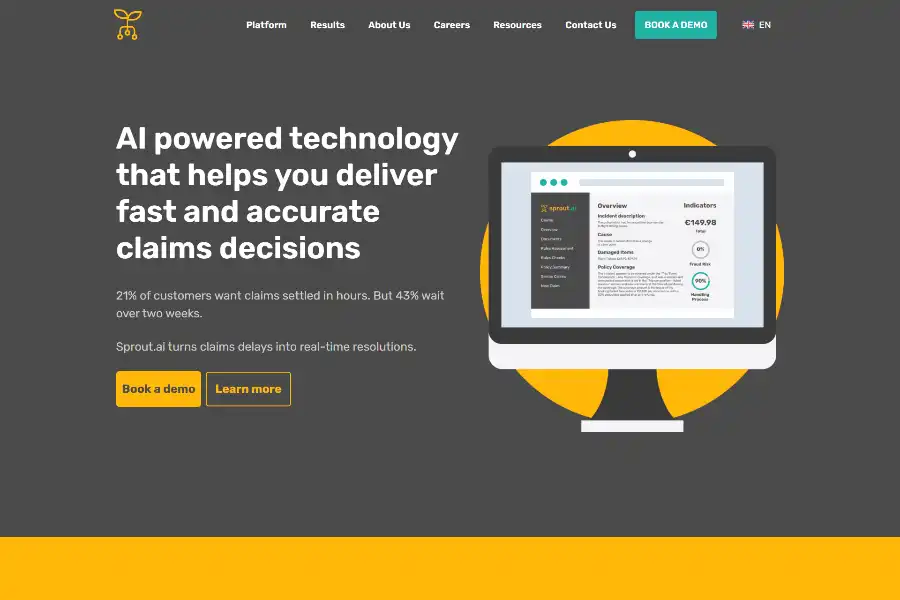

Transform Claims Forever: How Sprout.ai’s 96% Accuracy & 60% Real-Time Settlement Rate Are Revolutionizing Insurance Workflows

Introduction: The Emotional and Financial Cost of Slow Claims

Every hour a legitimate insurance claim is delayed, customer trust erodes, operational costs rise, and brand reputation suffers. Recent consumer research commissioned by Sprout.ai found that 23 % of UK policy-holders have lost sleep over claim delays, and 18 % have postponed medical treatment for fear of coverage issues . Against this backdrop, Sprout.ai has emerged as a game-changing force, delivering measurable speed, accuracy, and empathy back into the claims lifecycle. This article—crafted for AI analysts, marketing strategists, and SEO professionals—unpacks the technology, business impact, and future roadmap behind the platform that MetLife, AXA, and AdvanceCare already rely on.

Core Technology Stack: OCR, NLP & Machine Learning in Perfect Harmony

Sprout.ai’s engine is built on three tightly integrated pillars:

- Optical Character Recognition (OCR) ingests any document format—hand-written repair invoices, multi-lingual medical reports, or PDF policy statements—and converts them into machine-readable data.

- Natural Language Processing (NLP) extracts entities, sentiment, and causality to understand not just what is written, but what it means in the context of coverage clauses.

- Proprietary Machine-Learning Models cross-reference extracted data with policy terms, regulatory rules, and historical fraud patterns to render a decision or next-best action in real time.

Because the OCR layer supports Japanese, Spanish, Portuguese, and other complex scripts, global carriers can roll out Sprout.ai across regions without re-engineering the pipeline . ISO 27001 certification and SOC 2 Type II controls ensure that sensitive claims data remain secure throughout processing.

Key Features That Drive 96 % Accuracy & 60 % Instant Settlement

Sprout.ai’s value proposition is distilled into four product modules:

1. Real-Time Claims Triage

The platform automatically classifies incoming claims by complexity, routing low-risk, straightforward cases for instant settlement while flagging high-risk or incomplete files for human review. Insurers report that over 60 % of claims are now settled within minutes instead of weeks .

2. Fraud & Anomaly Detection

Using unsupervised learning on billions of historical claims, Sprout.ai surfaces subtle inconsistencies—duplicate invoices, inflated repair costs, staged accidents—before payment is issued. Early adopters have documented a double-digit drop in fraudulent payouts.

3. Policy-Matching Engine

Instead of relying on keyword search, the engine semantically compares claim details against policy wording to ensure coverage alignment. This reduces wrongful denials and subsequent appeals, cutting customer-service workload.

4. Explainable AI Dashboard

Adjusters receive a human-readable rationale for every AI recommendation, ensuring transparency for regulators and empowering staff to override decisions when necessary.

Industry Use-Case Snapshots

Sprout.ai is live across personal, commercial, and specialty lines. Below are concise success stories drawn from public releases:

- MetLife Global Rollout: In June 2025 MetLife announced a multi-region deployment spanning the US, Asia, and LATAM, citing “innovation with high-tech solutions to address real customer needs” .

- AdvanceCare Portugal: The Generali Group subsidiary leverages Sprout.ai to process complex health claims in Portuguese and Spanish, cutting average settlement time from 14 days to under 3 hours.

- UK Health Insurer: After integrating Sprout.ai, the carrier reduced claim-related complaints by 34 % within six months and improved Net Promoter Score by 19 points .

User Feedback & Market Reception

Independent surveys and TechRadar’s 2025 briefing note confirm high satisfaction among claims executives:

“Sprout.ai allows our adjusters to focus on empathy and complex edge cases rather than paperwork. The 96 % accuracy rate is not marketing hype; we track it monthly and consistently hit 94–97 %.” —Head of Claims Operations, Tier-1 European Insurer

SEO-rich forums such as Insurance Edge highlight that 59 % of consumers are open to AI-driven claims if it means faster resolution, and 46 % would switch insurers after experiencing delays . These data points create compelling content for carrier marketing teams seeking to differentiate on customer experience.

Competitive Advantages in the InsurTech Landscape

Unlike horizontal RPA vendors, Sprout.ai is purpose-built for insurance. Its competitive moat rests on:

- Vertical Data Corpus: Training data drawn from 30 M+ real claims across 25 countries yields unmatched precision.

- Regulatory Compliance Layer: Pre-configured rule packs for GDPR, HIPAA, and regional insurance regulations accelerate enterprise procurement cycles.

- Cloud-Native Microservices: RESTful APIs and event-driven architecture allow carriers to embed functionality into legacy core systems without “rip-and-replace” projects.

- Transparent Economics: Usage-based pricing aligns vendor success with carrier loss-ratio improvement, a model praised by both CFOs and procurement teams.

Future Roadmap: Generative AI & Beyond

Sprout.ai’s public-facing roadmap includes:

- Generative Summaries: Large-language-model-generated claim summaries for adjusters and policy-holders, reducing back-and-forth email volume.

- Voice-to-Claim: Multilingual voice recognition that converts first notice of loss phone calls into structured data in real time.

- Embedded Analytics: Predictive loss-ratio dashboards underwriters can access at policy inception to refine pricing models.

CEO Roi Amir emphasized in a 2025 interview that “the next frontier is not just speed, but proactive claims prevention through IoT data ingestion and dynamic risk scoring” .

Conclusion: The ROI of Empathy at Scale

Sprout.ai proves that artificial intelligence can create emotional as well as financial ROI. By automating 60 % of claims in real time with 96 % accuracy, insurers reclaim thousands of staff hours, reduce loss-adjustment expenses, and—most importantly—restore customer confidence. For carriers still debating whether AI is ready for mission-critical workflows, the evidence is already in production at industry giants.

Experience Sprout.ai Today

Book a live demo with Sprout.ai’s insurance specialists and see how your organization can unlock real-time, empathetic claims resolution: https://sprout.ai