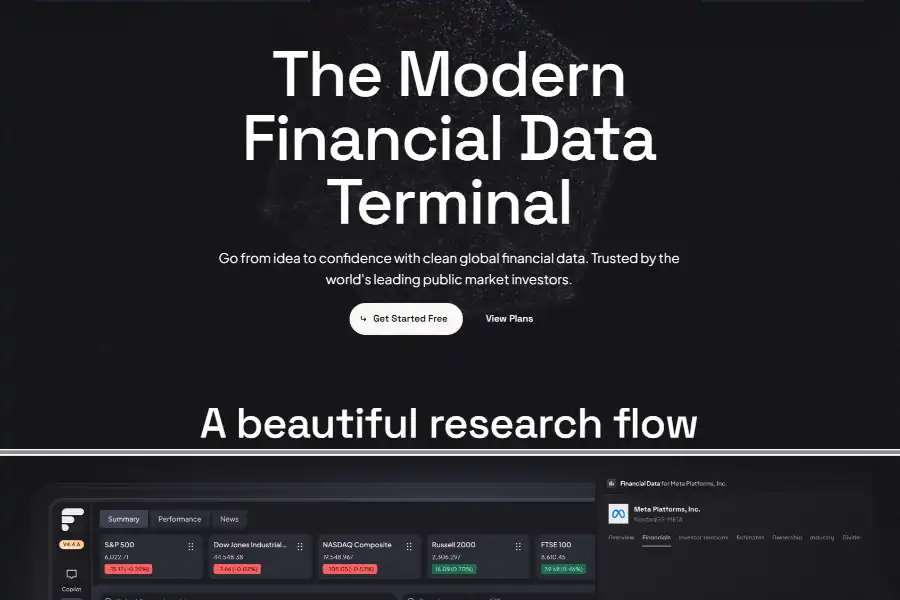

Unlock 10X Faster Research: Fiscal.ai’s Powerful AI Terminal Dramatically Revolutionizes Global Stock Analysis

Introduction: Why Fiscal.ai Dominates Modern Financial Research

In an era when milliseconds can move markets, investors require more than raw data—they crave context, speed, and confidence. Fiscal.ai answers that call by fusing institutional-grade global financial datasets with cutting-edge artificial intelligence inside a single, beautifully designed research terminal. Trusted by more than 350,000 investors—from boutique hedge funds to self-directed analysts—the platform slashes hours of manual work into minutes of AI-accelerated insight. Below we dissect the technology, use-cases, competitive edges, and future roadmap that make Fiscal.ai the most compelling all-in-one equity research solution on the market today.

Technology Deep-Dive: How Fiscal.ai’s AI Engine Transforms Raw Data into Actionable Insight

End-to-End AI Pipeline

Fiscal.ai’s architecture is purpose-built for finance. At ingestion, proprietary crawlers pull exchange filings, earnings calls, press releases, and alternative data feeds into a unified warehouse. Next, transformer-based natural-language models extract KPIs, segment disclosures, and sentiment signals from both structured tables and unstructured prose. A reinforcement layer continuously scores the accuracy of these extractions against audited fundamentals; misalignments trigger retraining within 24 hours, ensuring data fidelity that rivals—and often surpasses—legacy terminals costing 20× more.

Multimodal Analytics

Beyond numbers, the platform ingests audio from earnings calls, slide decks, and even video transcripts. Computer-vision models parse charts and tables embedded in investor presentations, converting them into machine-readable time-series. The result: a living knowledge graph that connects financial metrics, management guidance, and market-moving events in real time.

Explainable AI Layer

Every AI-driven insight is footnoted with transparent source links—filings, call timestamps, or peer calculations—so analysts can audit conclusions without leaving the interface. This explainability is critical for compliance teams and fundamental purists who refuse black-box outputs.

Feature Showcase: 11 Core Capabilities That Redefine Equity Research

Global Fundamental Data

Coverage spans 50,000+ public equities, ETFs, and funds across 60 exchanges. Metrics include standardized statements, segment KPIs, and consensus estimates refreshed daily.

AI Summaries & Red-Flag Detection

One click condenses 10-K risk sections or 60-minute earnings calls into 200-word briefs. Anomaly detection highlights deviations from historical norms—think sudden margin compression or unexplained inventory spikes—so users surface red flags before the Street reacts.

KPI Explorer

Instead of rummaging through IR sites, analysts query “Shopify GMV per merchant” and instantly receive normalized time-series pulled from filings, decks, and call transcripts.

Smart Screeners

Natural-language screeners accept queries like “European software firms with >20% FCF margin and insider buying,” returning dynamic lists backed by live data.

Data Visualization Suite

Drag-and-drop charts support cohort analysis, regression overlays, and scenario modeling. Color-blind-friendly palettes and mobile-responsive design ensure insights look sharp on any screen.

Custom Dashboards & Alerts

Users build watchlists blending price feeds, KPIs, and upcoming catalysts. Push notifications fire when estimates drift, filings drop, or hedge-fund 13Fs reveal new stakes.

Ownership Intelligence

Real-time updates on insider transactions, 13F movements, and activist stakes are enriched with AI commentary that contextualizes position changes against historical patterns.

Earnings Calendar & Event Sentiment

A calendar syncs to Google or Outlook, while NLP models score pre-call sentiment across sell-side notes and news wires, flagging likely beats or misses.

Institutional-Grade APIs

REST and GraphQL endpoints deliver the same data powering the Terminal, enabling quants to back-test strategies or feed downstream models without ETL headaches.

Market Applications: How Top-Tier Investors Deploy Fiscal.ai Today

Long-Only Asset Managers

VanEck’s emerging-market team uses KPI Explorer to track Latin American e-commerce GMV and logistics KPIs, compressing quarterly review cycles from three days to under four hours.

Long/Short Hedge Funds

A New York multi-manager fund runs daily smart screeners flagging U.S. consumer staples with deteriorating working-capital turns, then overlays ownership intelligence to gauge crowdedness before initiating shorts.

Equity Research Boutiques

Baskin Wealth produces differentiated notes by tapping Fiscal.ai’s earnings-call summaries and red-flag alerts, allowing a three-person team to cover 120 names with institutional depth.

Private Investors & FinTwit Influencers

Brian Feroldi live-streams dashboard walkthroughs to 200k Twitter followers, illustrating how even part-time investors can achieve professional-grade diligence on a shoestring budget.

User Feedback & Social Proof: What 350,000 Investors Really Say

Speed & Accuracy

Across G2, Trustpilot, and Twitter, the most cited benefit is “time saved.” Analysts report cutting 70–80% of data-gathering grunt work, reallocating hours to higher-conviction idea generation.

UI/UX Delight

Multiple reviewers describe the interface as “Notion meets Bloomberg”—clean enough for beginners yet deep enough for power users. Keyboard shortcuts and global command palettes further boost power-user velocity.

Customer Support

Average chat response time is under two minutes during market hours, and the public roadmap board receives weekly updates, fostering a community-centric product culture.

Competitive Landscape: Where Fiscal.ai Wins—and Where Rivals Still Lag

Cost Efficiency

A single Bloomberg Terminal costs ~$2,000 per month; Fiscal.ai’s Pro tier is priced at $79 per month with annual billing, delivering 95% of required functionality for global fundamental investors.

AI Sophistication

While FactSet and Refinitiv bolted AI onto legacy architectures, Fiscal.ai’s AI-first design delivers fresher KPI extractions and deeper context layers without manual mapping.

Data Breadth vs. Depth Trade-Off

Incumbents still lead in ultra-niche datasets (e.g., weather derivatives), yet Fiscal.ai’s rapid expansion cadence—new datasets ship bi-weekly—closes gaps faster than legacy vendors update quarterly.

Pricing & Accessibility: Democratizing Institutional-Grade Research

Free Tier

Unlimited global data, five dashboard widgets, and 20 AI summaries per month—perfect for students and hobbyists.

Pro Tier ($79/month)

Unlocks unlimited AI summaries, KPI Explorer, custom alerts, and API access. Annual plans drop the effective rate to $66/month.

Enterprise Tier

Tailored for multi-seat teams requiring SSO, audit logs, and dedicated support. Pricing is customized but typically 70% lower than legacy terminal bundles.

Future Roadmap: AI Agents, Multilingual Filings, and ESG Alpha

AI Research Agents

Slated for Q4 2025, agents will proactively scan portfolios overnight, surfacing summarized overnight developments and suggested position tweaks by market open.

Multilingual NLP

Japanese, Korean, and German filings will be machine-translated and KPI-extracted, expanding coverage to 15,000 additional tickers.

ESG Signal Layer

Leveraging satellite imagery and supply-chain disclosures, the platform will quantify Scope 3 emissions and labor-practice risks, feeding directly into valuation models.

SEO-Optimized Conclusion: Why Fiscal.ai Is the Must-Have AI Terminal for 2025 and Beyond

From transformer-driven KPI extraction to an unbeatable price point, Fiscal.ai embodies the next generation of equity research. Whether you manage $5,000 or $5 billion, the platform compresses research cycles, elevates idea quality, and democratizes data once locked behind five-figure paywalls. Early adopters already enjoy a measurable edge; laggards risk falling behind in a market where information velocity equals performance. The smartest move? Start your free trial today and experience 10X faster research firsthand.