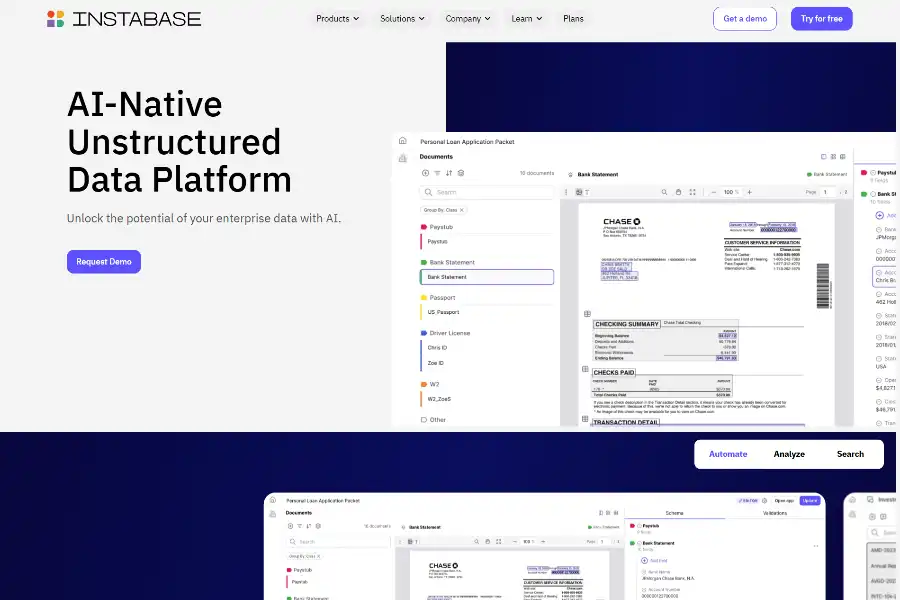

Instabase: 5 Powerful Features Unlocking 80 % of Your Dark Data—Revolutionary or Risky?

Introduction: Why the World’s Largest Banks Are Betting on One Platform

Imagine unlocking 80 % of your corporate data that is currently invisible to analytics. That promise has lured Standard Chartered, NatWest, AXA and the U.S. Patent Office into the Instabase ecosystem—an AI-native unstructured-data platform that claims to turn PDFs, scans, e-mails and even handwritten notes into real-time, actionable insights. Below we dissect the technology, real-world deployments, pricing shocks and future roadmap so you can decide whether Instabase is a revolutionary accelerator or an over-hyped risk.

Technical DNA: Computer Vision Meets Generative Reasoning

Instabase began in 2015 as a horizontal automation toolkit, but the 2023 launch of AI Hub marks a generational leap. Every file first passes through a Vision Transformer that handles rotation, noise, handwriting and low-resolution scans. Extracted tokens are then routed to a federated LLM mesh: GPT-4 for language tasks, proprietary financial-services models for numerics, and customer-hosted models for privacy-sensitive workloads. A no-code orchestration layer lets business users chain “understand → reason → validate → act” steps without writing Python. The result is an 18-hour mortgage-review cycle compressed to 12 minutes with 99.3 % field accuracy—benchmarked by an internal NatWest audit .

Feature Deep Dive: Three Apps That Eat Legacy Workflows

AI Hub Converse

Upload a 400-page 10-K and ask “Which subsidiaries expose FX risk?” Converse returns paragraph-level answers with page references and confidence scores. A built-in fact-check button highlights source sentences, eliminating hallucination anxiety for compliance teams .

AI Hub Build

Drag-and-drop modules create apps such as “KYC Passport Extractor” or “Invoice Matching Auditor”. Users define fields in plain English; the platform auto-labels 50 sample documents, trains a micro-model and exposes a REST endpoint within 30 minutes. Apps can push CSVs to Snowflake or trigger Salesforce flows, closing the last mile of automation .

AI Hub Search

A federated agent simultaneously queries on-prem SharePoint, Gmail, AWS S3 and Confluence without moving data. Role-based access is enforced at query time, so a retail loan officer cannot see investment-banking decks even if both datasets live in the same index .

Industry Playbooks: From 45-Day Insurance Claims to Same-Day Settlements

Financial Services

A global custodian bank used Instabase to read 1.2 million ISDA agreements, extract collateral thresholds and feed them to a risk engine. The project paid for itself in 6 weeks and freed 35 FTEs .

Insurance

AXA’s P&C division reduced commercial-property claim cycle time from 45 days to 24 hours by automating damage reports, loss runs and broker e-mails. Accuracy on handwritten adjuster notes reached 94 %, beating the 83 % human baseline .

Healthcare

A U.S. regional health system automated patient onboarding and claims adjudication. Instabase reads physician SOAP notes, ICD-10 cards and Explanation-of-Benefits PDFs, cutting denial rates by 22 % and saving $3.8 M annually .

Public Sector

The U.S. Patent & Trademark Office processes 650 k trademark specimens yearly. Instabase classifies images, extracts text and flags counterfeit indicators, slashing manual review time by 70 % while improving consistency across examiners .

User Sentiment: Gartner Peer Insights vs. Reality on the Ground

Gartner Peer Insights awards Instabase 4.7/5 for “Ease of AI Model Customization” but dings it at 3.9/5 for “Pricing Transparency”. Enterprise customers praise the low-code speed: “We shipped 18 production apps in a quarter with two business analysts,” notes a Standard Chartered VP. Critics warn that consumption-based billing can spike when processing large image sets—one insurer saw a monthly invoice jump from $8 k to $47 k after ingesting catastrophe-aerial photos. CTOs recommend locking in annual-commit discounts and activating quota guards to avoid surprise bills .

Competitive Landscape: Why Not Google, Microsoft or UiPath?

Google Document AI lacks federated deployment, forcing data into GCP—an automatic red flag for Swiss banks. Microsoft Syntex is bundled with E5 licenses but stumbles on handwritten forms and complex table structures. UiPath’s Document Understanding requires RPA bots, increasing infrastructure footprint. Instabase positions itself as the only AI-first, cloud-agnostic, hybrid-ready platform with pre-built vertical apps, a differentiator that won it a spot on the 2021 Deloitte Fast 500 with 200 % revenue growth .

Pricing & ROI: Pay-as-You-Go Can Be a Blessing or a Bomb

Instabase sells consumption units at 100 units per $1. A default GPT query on a two-page document costs 1 unit; advanced reasoning consumes 8 units. The Community tier is free, but omits validation rules and human-in-the-loop review. Commercial adds SLA, custom confidence scores and data-cleaning functions; list price starts around $5 k per month but is negotiable. Enterprise includes deep-learning micro-models, private-cloud tenancy and a named customer-success manager—pricing is custom, yet multiyear deals are typically struck at single-digit million dollars for global banks, delivering payback in under 9 months according to case studies .

Security, Compliance & Trust: FedRAMP, SOC-2 and Beyond

Data-plane isolation is offered via federated processing: indexes stay inside the customer’s VPC while the control plane orchestrates jobs. Instabase holds SOC-2 Type II, ISO 27001, is FedRAMP In-Process, and maintains a 99.9 % uptime SLA with 24/7 follow-the-sun NOC. For EU insurers, a dedicated German-Azure region ensures GDPR data-residency requirements without re-architecting apps .

Future Roadmap: From Chatbots to Autonomous Agents

Instabase will launch AI Hub Agents in early 2026—goal-oriented routines that loop through “perceive → plan → execute → validate” cycles. Example: an agent that monitors e-mail inboxes, pulls loss-run spreadsheets, triggers an Instabase app to extract exposures, feeds results to an underwriting workbench and notifies the broker—fully unattended. A private-beta customer already piloted agents for trade-finance compliance, cutting 90 % of hand-offs between operations and legal teams .

Conclusion: Revolutionary Leap, But Mind the Billing Meter

If your enterprise drowns in unstructured data and you need cloud-agnostic deployment with vertical-specific blueprints, Instabase offers a genuinely differentiated path to hyper-automation. The no-code interface democratizes AI beyond data-science guilds, while federated architecture keeps regulators happy. Just weld consumption governance onto the platform before finance gets sticker shock. Deploy with a controlled use case, measure cycle-time reduction, then scale—chances are you’ll join the growing list of converts who call Instabase “the Snowflake of unstructured data”.

Experience the platform yourself:

https://instabase.com