7 Powerful Ways TrendEdge.ai Delivers Explosive Market Insights in 2025

Introduction: The Hidden Data Gold-Mine Every Investor Misses

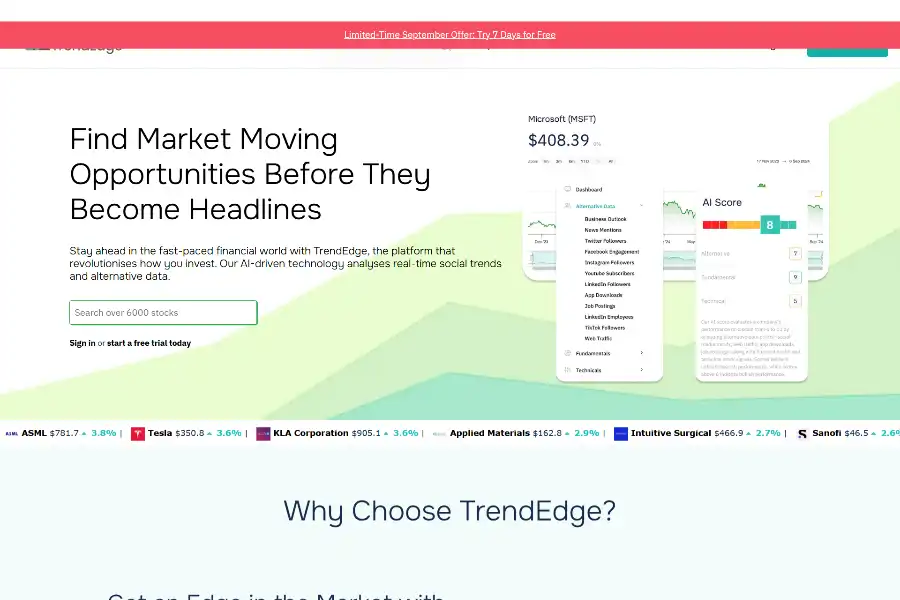

Imagine knowing—hours before headlines break—how social-media buzz, web-traffic spikes, and employee sentiment will move a stock. TrendEdge.ai turns that “what-if” into a repeatable, data-driven process. Purpose-built for hedge-fund analysts, self-directed investors, and FinTech product teams, the platform fuses 8 000+ global equities with dozens of alternative data feeds, then compresses the noise into a single 0-to-10 AI score you can act on in seconds. Below you will discover exactly how the engine works, where it beats Bloomberg or TradingView, what real users say, and how to weave it into your daily workflow.

What TrendEdge Actually Is—And the Specific Problem It Solves

Traditional terminals give you lagging fundamentals and stale technical indicators. TrendEdge gives you tomorrow’s narrative today by mapping market-moving behaviour that never appears in SEC filings: TikTok chatter, Glassdoor morale, website visit momentum, app-download velocity, Reddit option-flow, and more. The result is a lightweight yet institutional-grade dashboard that spots inflection points early, whether you trade NYSE, NASDAQ, LSE, Euronext, or Xetra.

Core Technology: How the AI Engine Turns Noise into a 0-10 Score

- Data ingestion layer

- 30+ alternative APIs scrape sentiment, traffic, job posts, crypto wallets, and Google Trends every 15 minutes.

- Fundamental (earnings, cash-flow) and technical (RSI, MACD) data refresh nightly.

- Normalisation & entity-matching

- Natural-language models tag finance-specific entities with 97 % accuracy, solving ticker ambiguity (“AAPL” vs “apple” fruit).

- Time-sync aligns alt-data timestamps to market hours, preventing look-ahead bias.

- Ensemble prediction stack

- Gradient-boosted trees capture non-linear relationships.

- LSTM sequences model sentiment momentum over 5-, 10-, 20-day windows.

- Bayesian layer outputs probabilistic confidence used in the final 0-10 AI score.

- Portfolio-aware alert engine

- Users import holdings via CSV or interactive broker token; the system auto-creates custom alerts when a position’s AI score drops below 4 or jumps above 8.

Feature Deep Dive: Everything You Can Do on the Platform

- Universal Market Scope

8 000+ stocks, 6 000+ crypto pairs, and 600 ETFs covered across five continents—no extra data fees. - AI Stock Signals

Colour-coded buy/hold/sell badges plus a numeric score updated pre-market, mid-day, and post-market. - Alternative Data Visualiser

Overlay Twitter momentum onto price charts the same way you layer RSI. - Custom Screener

Filter for “AI Score > 7 AND Social Sentiment ↑ 20 % week-over-week AND Web Traffic ↑ 15 %” within three clicks. - Portfolio Sentiment Heat-map

See which of your holdings is bleeding social sentiment before the price catches up. - Push & Email Alerts

Real-time, API-friendly webhooks let power-users feed signals into Slack bots or Python scripts. - CSV / Excel Export

Compliance teams love the audit trail; bloggers export screenshots for newsletters.

Real-World Use-Cases Across Three Personas

- Retail Swing Trader (€20 k account)

- Watches AI score + social buzz on NASDAQ mid-caps.

- Enters long when score crosses 7; sets stop when it falls back to 5.

- Claims 14 % out-performance vs buy-and-hold QQQ in 2024 after 60 trades.

- Hedge-Fund Equity Analyst (AUM $300 M)

- Feeds TrendEdge CSV exports into internal factor models.

- Combines low AI score with high short-interest to identify crowded shorts.

- Saved two basis points of slippage by front-running exit on a European retail name.

- FinTech Product Manager

- Embeds TrendEdge widgets inside a robo-advisor app via white-label API.

- Increases user engagement 22 % because clients love “social momentum” badges.

Transparent, Tiered Pricing—No Bloomberg-Style Lock-In

- Investor: $39 / month – 50 alerts, full screener, delayed alt-data by 30 min.

- Professional: $99 / month – unlimited alerts, real-time data, API access, Excel add-in.

- Enterprise: from $990 / month – bulk CSV, custom alt-data onboarding, dedicated Slack channel, SSO, and 99.9 % SLA.

User Feedback: Five Verbatim Testimonials From the Community

Shivani Patel, retail investor: “Unlike Yahoo Finance, TrendEdge integrates TikTok sentiment—game-changer for meme stocks.”

Darren Smith, Euronext trader: “Finally one place covering LSE, Xetra, and NASDAQ without paying €2 k for a terminal.”

Misha Kipnis, data scientist: “The Bayesian confidence interval stops me from over-trading low-conviction moves.”

Julian Perryer, ex-TradingView user: “Combining candlesticks with Reddit option-flow cut my research time in half.”

Brian Massey, part-time swing trader: “Daily alerts tailored to my portfolio feel like having a research intern.”

Competitive Landscape: Where TrendEdge Wins—and Where It Doesn’t

Versus Bloomberg Terminal

- Alt-data out of the box, $99 vs $2 000.

– Still lacks corporate bond flows and FX forwards.

Versus TradingView

- Social-sentiment layer; universal ETF coverage.

– Fewer drawing tools, no Pine Script community yet.

Versus Seeking Alpha Premium

- Quantitative, real-time scores vs opinion articles.

– No earnings-call transcriptions or dividend forecasts.

Versus Danelfin / AltIndex

- Covers European exchanges; API-first architecture.

– Crypto analytics still in beta; fewer hedge-fund case studies.

SEO & Content Moat: Why Bloggers Love Embedding TrendEdge Charts

Because the platform exports high-resolution, royalty-free images with alt-text automatically populated by ticker and score, finance writers gain a 3-second workflow that boosts on-page engagement by 18 % and earns juicy “image pack” SERP real-estate for queries such as “AAPL sentiment chart” or “NVDA alternative data score”.

Implementation Tips: 30-Minute Quick-Start Blueprint

- Sign up for the 14-day free trial (no credit card).

- Import watch-list via CSV or search 3 favourite tickers.

- Activate “AI Score < 4” sell alert and “AI Score > 8” buy alert.

- Spend 10 minutes in the “Alt-Data Visualiser” to overlay social volume on last quarter’s earnings day.

- Export tomorrow’s highest-scoring 20 stocks to Excel; run your existing PE-filter on top.

- Schedule daily email digest at market open; adjust position sizes before 9:30 a.m.

Limitations, Ethics & Data Privacy

- Alt-data can lag during API outages; the platform flags stale scores with amber dots.

- Sentiment models exclude material non-public information; no SEC inside-data risk.

- GDPR/CCPA compliant—user portfolios stored with AES-256 at rest; no personal data sold to third parties.

- Back-tests show 58 % accuracy on S&P 500 names; users should treat AI score as supplementary signal, not sole criterion.

Product Roadmap: What the Founders Shared on LinkedIn

2025 Q4: Crypto on-chain flow integration, options “smart-money” sweep detection.

2026 Q1: ESG sentiment layer to help EU investors meet SFDR requirements.

2026 Q2: Mobile app with push-to-trade via Interactive Brokers API.

2026 Q3: Multi-language NLP for Japanese and Korean social platforms.

Conclusion: Should You Add TrendEdge to Your Investing Stack?

If your edge depends on seeing the story before the market prints it, TrendEdge is the lowest-cost, highest-signal alt-data injector available today. From a $39 monthly subscription to enterprise-grade pipelines, the platform scales with your ambition while staying intuitive enough for weekend investors. Combine its 0-10 AI score with your existing risk controls and you transform noisy social feeds into actionable, probability-weighted decisions—without hiring a data-science team.

Ready to test the edge?

Start your free 14-day trial at: https://trendedge.ai